What Is Capital Allowance Uk

List of information about capital allowances.

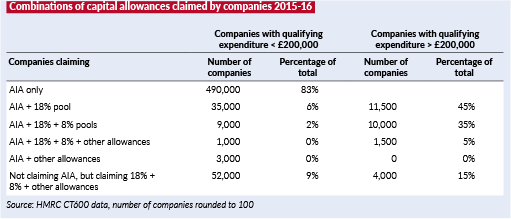

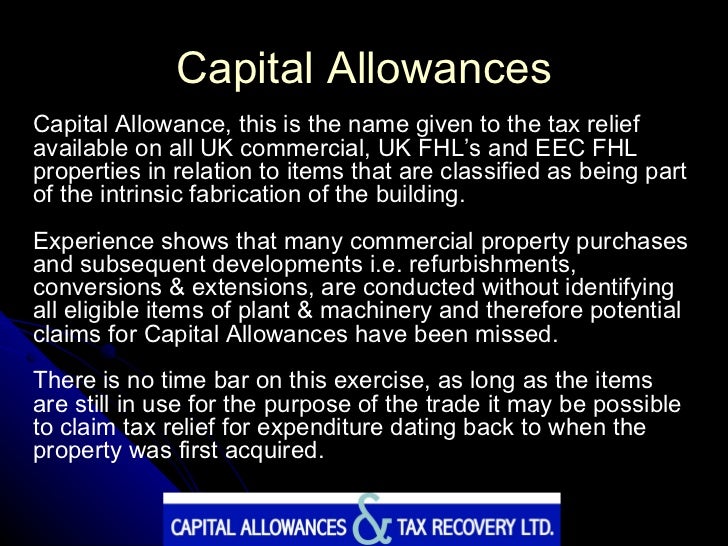

What is capital allowance uk. Here s a rundown of what capital allowances are and how they work in the uk. You can claim capital allowances when you buy assets that you keep to use in your business for example. Unusually the irish corporate tax system has a capital allowances for intangible assets scheme which. We use this information to make the website work.

This is called capital expenditure. Or irish business may claim against its taxable profit. Aa 100 of the principal payment and deposit paid where applicable you can also choose to defer the capital allowance claims to subsequent yas. Business vehicles for example cars vans or lorries.

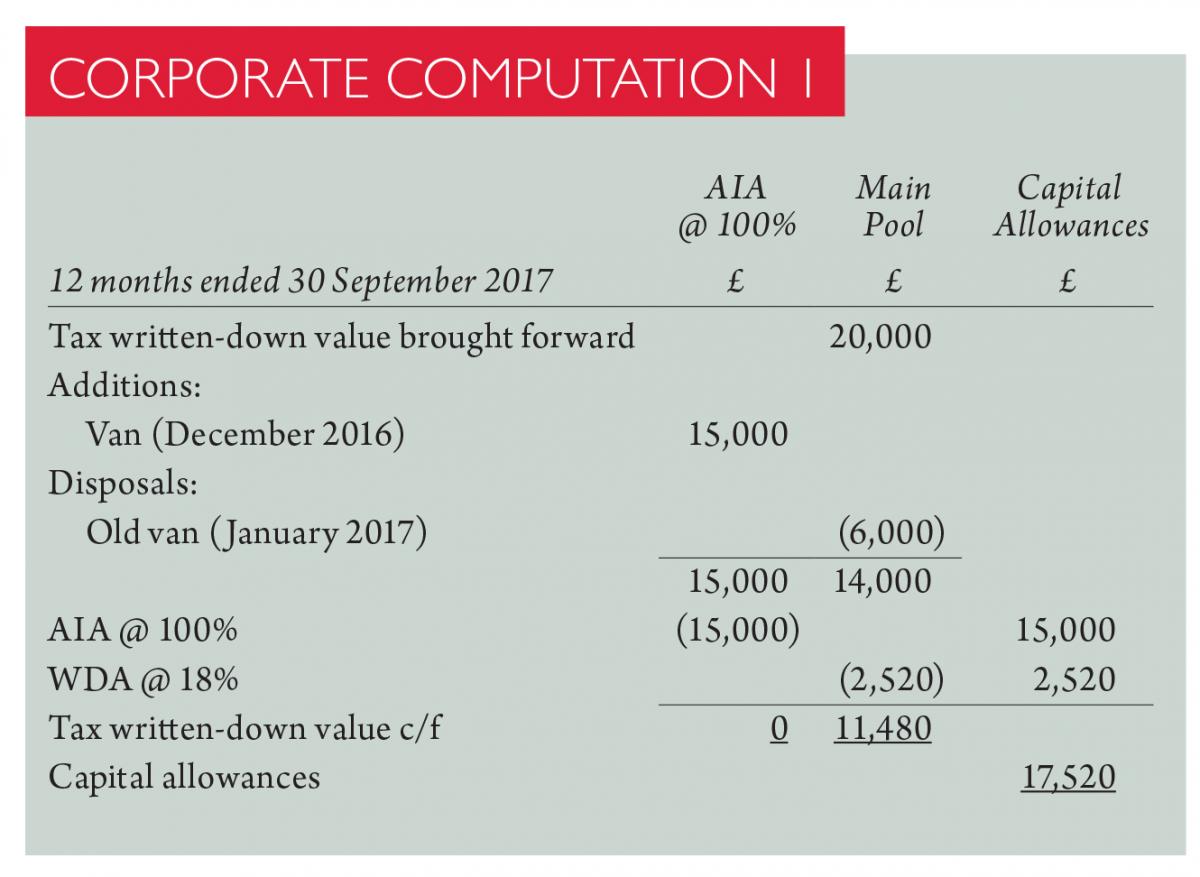

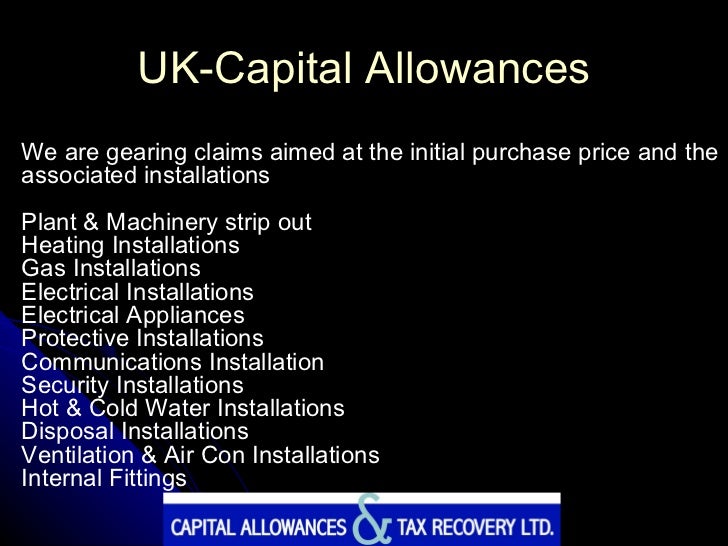

Capital allowances may be claimed on most assets purchased for use in the business ranging from. Track the depreciation of your assets easily with invoicing accounting software like debitoor. For assets purchased by cash. Capital allowances are generally granted in place of depreciation which is not deductible.

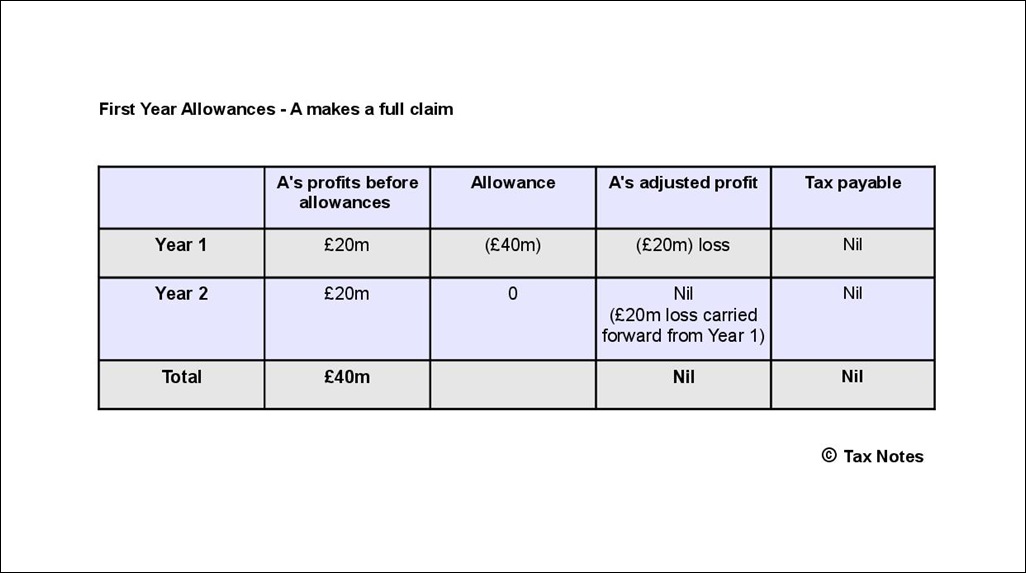

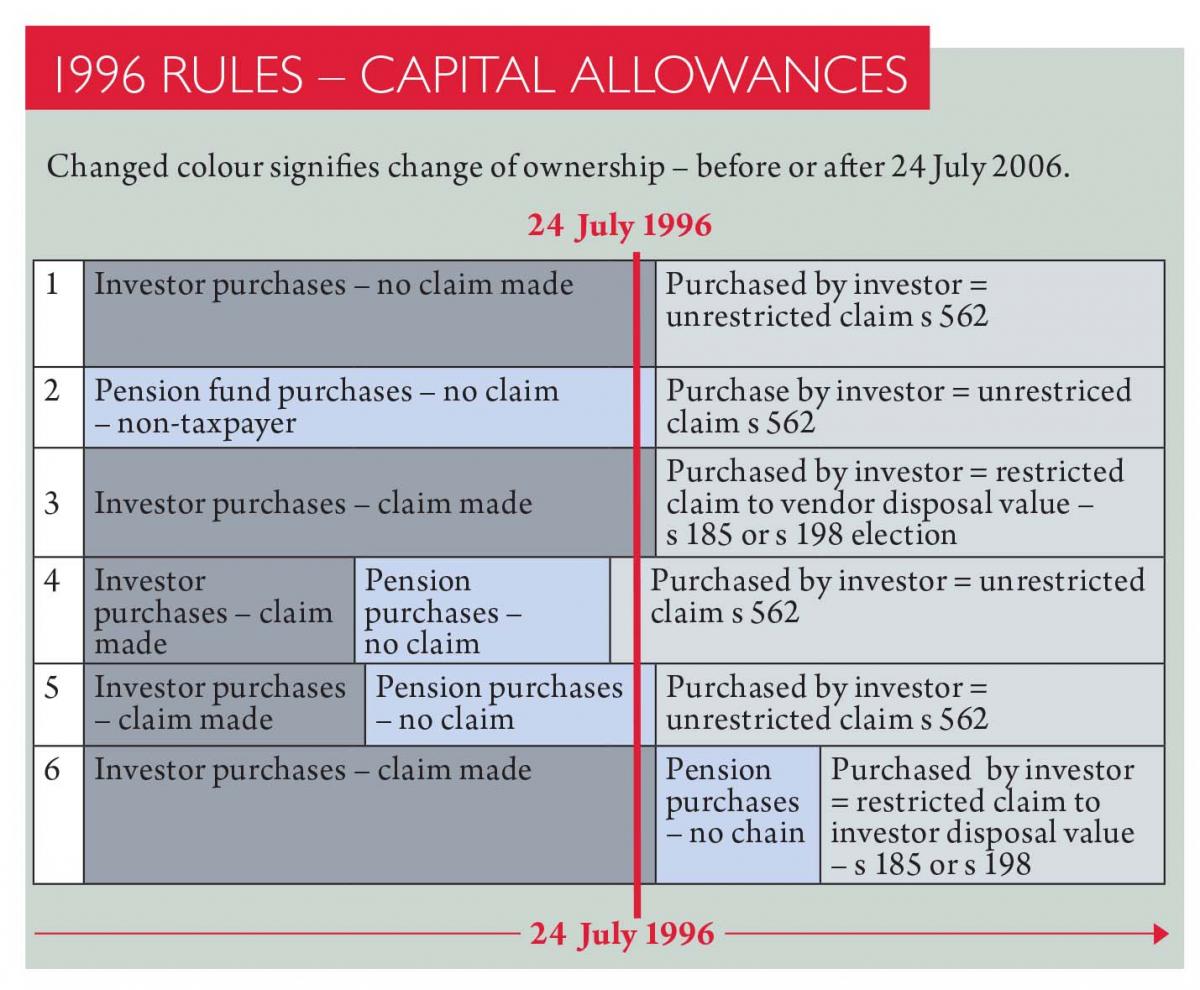

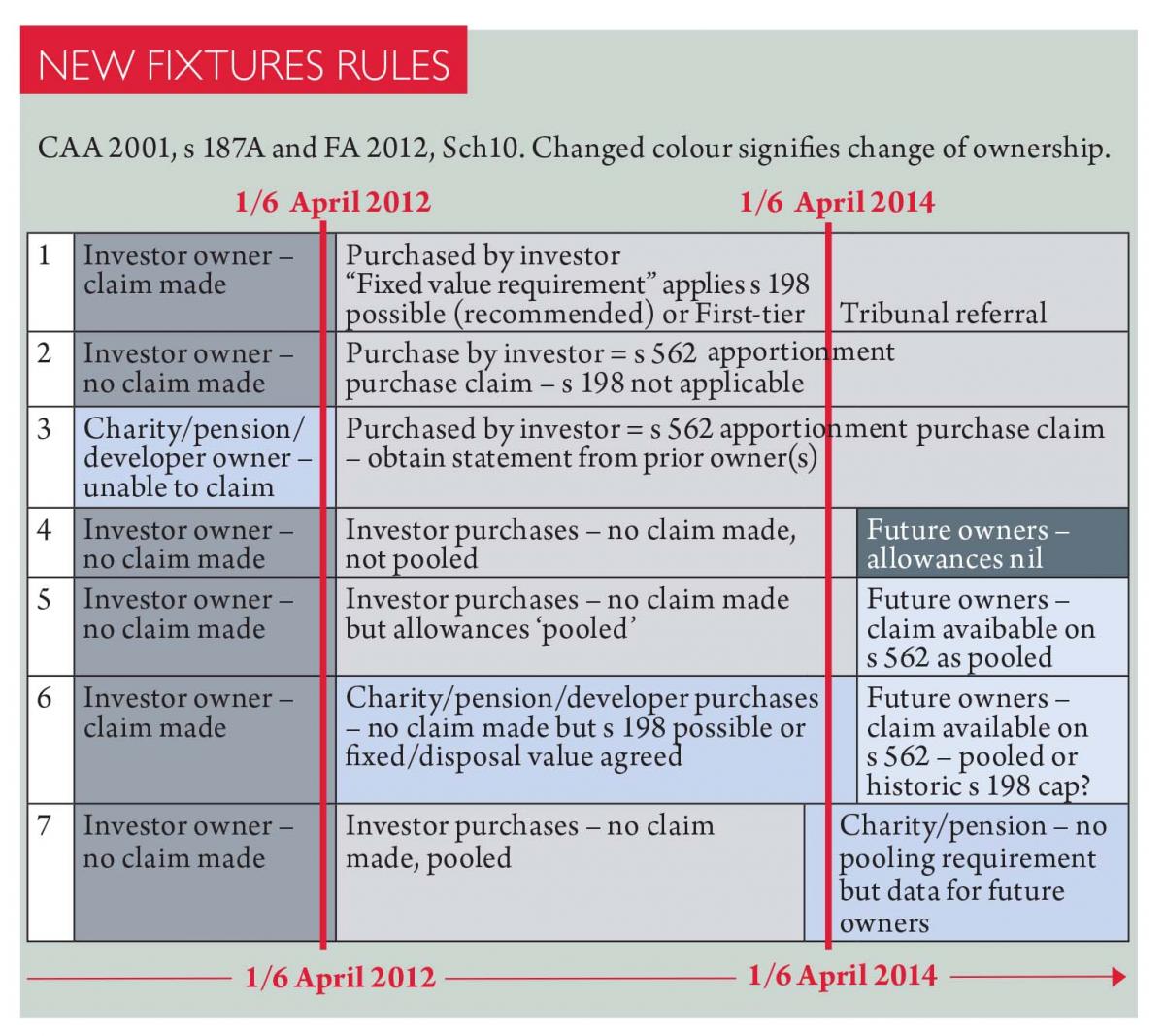

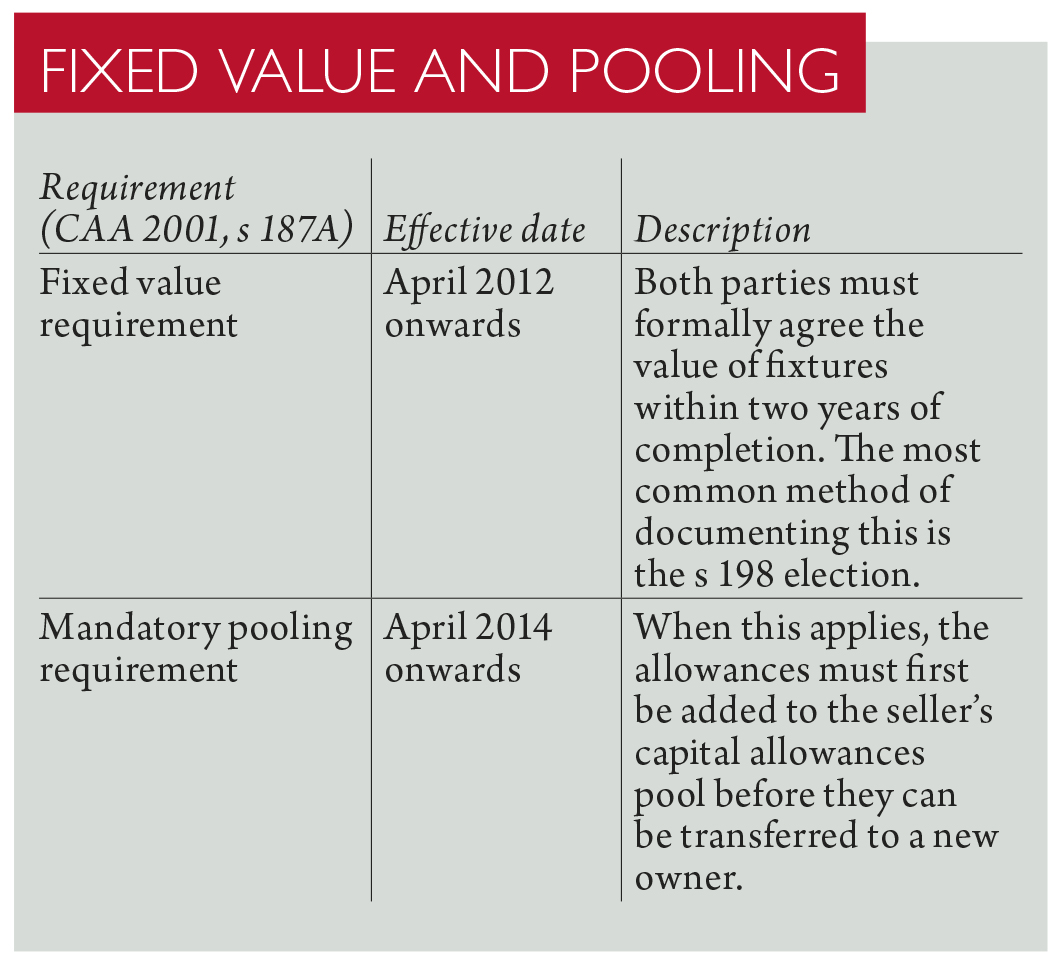

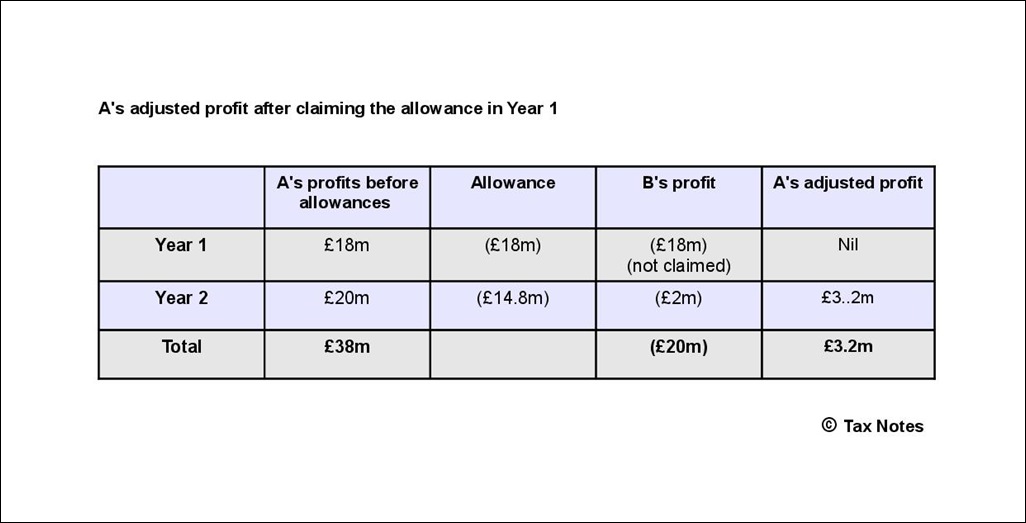

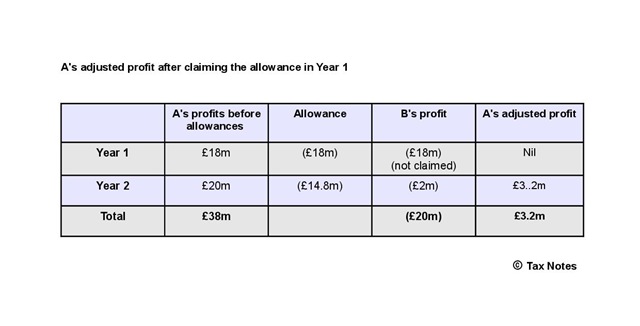

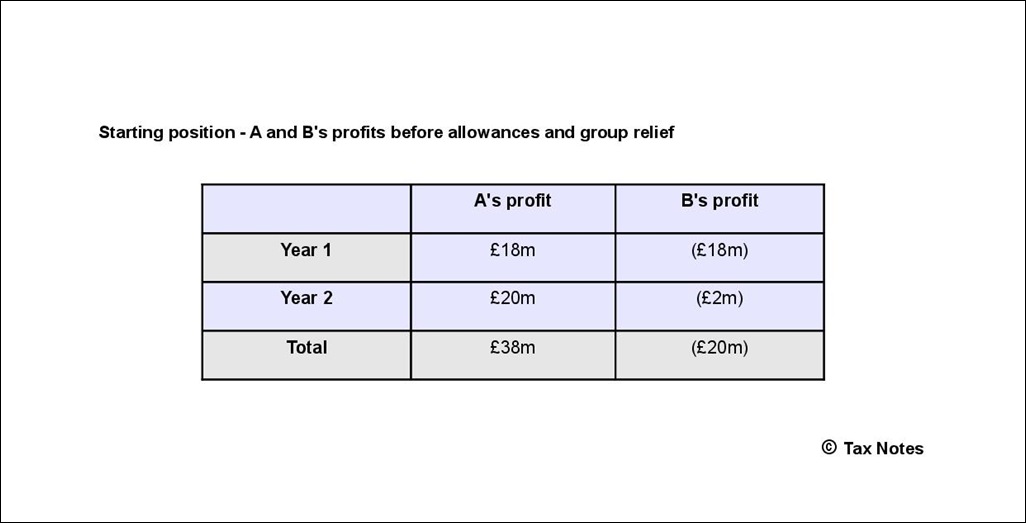

Capital allowances is the practice of allowing a company to get tax relief on tangible capital expenditure by allowing it to be expensed against its annual pre tax income. They effectively allow a taxpayer to write off the cost of an asset over a period of time. Capital allowances are deductions claimable for the wear and tear of qualifying fixed assets such as industrial machinery office equipment and sign boards. Capital allowance is an amount of money spent on business assets that can be subtracted from what a business owes in tax.

The term is used in the uk and in ireland. Capital allowances are a way of reducing your tax bill when you spend money on something that ll benefit your business in the long term. If amber purchases a car with higher co2 emissions so above 110g km which costs 8 000 then the capital allowances would not be eligible for first year allowances instead it would fall under the special rate pool and receive capital allowances at 6. We use cookies to collect information about how you use gov uk.

Generally the capital allowances will exist for only specified items of tangible capital expenditure and the expensing is usually spread over a fixed period of years. Tell us whether you accept cookies. What are capital allowances. A capital allowance is an expenditure a u k.

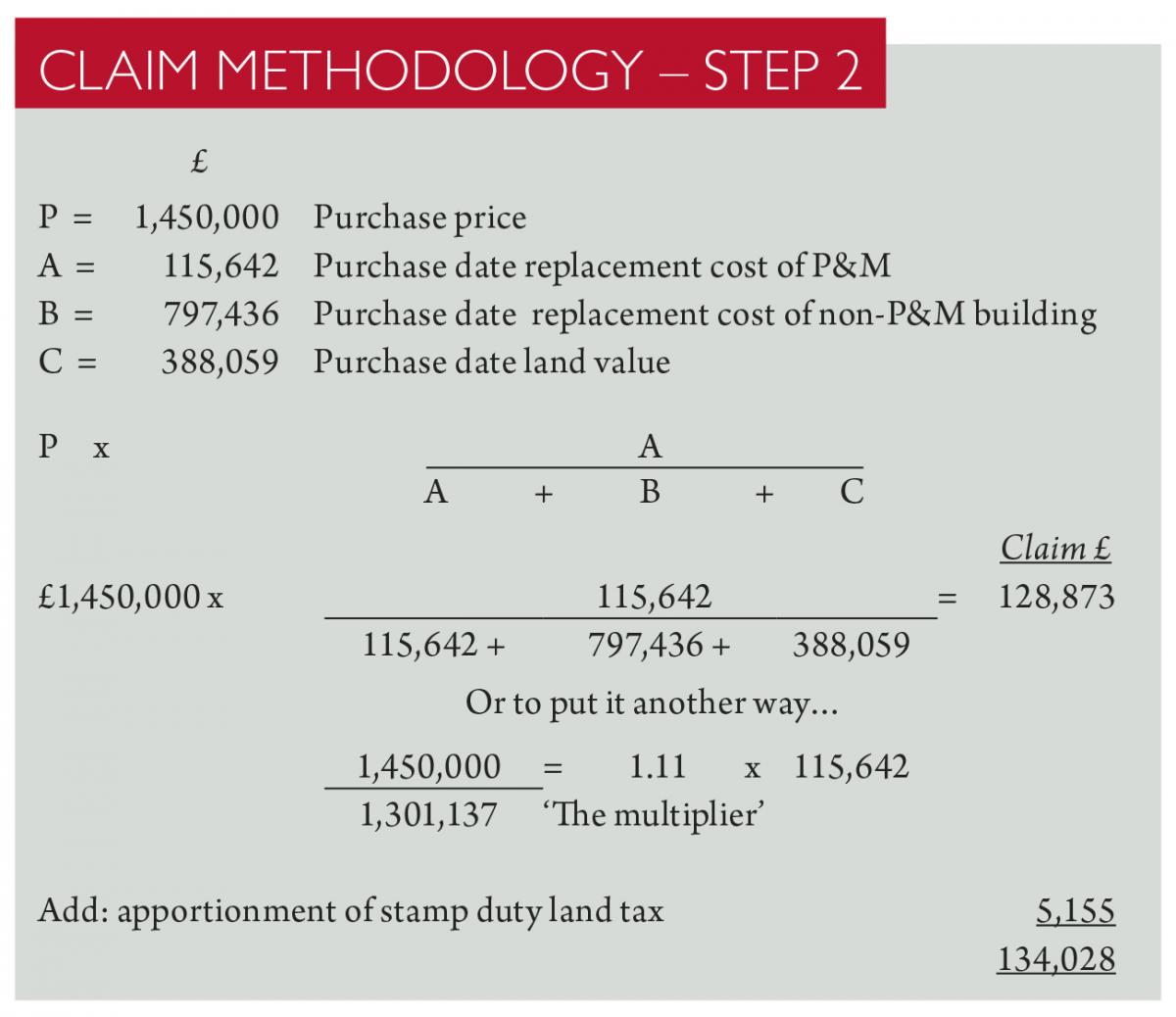

Under the 100 write off capital allowance is allowed in the form of annual allowance aa where. To get your tax deduction you ll have to claim capital allowances. For assets purchased under hire purchase. Capital allowances are akin to a tax deductible expense and are available in respect of qualifying capital expenditure incurred on the provision of certain assets in use for the purposes of a trade or rental business.

Try it free for 7 days.

.jpg)