Unclaimed Money Act Malaysia

The inspection focuses on creditor balances which have been long unpaid debtor balances in credit and long outstanding bank reconciliation items and other liabilities which have remained dormant.

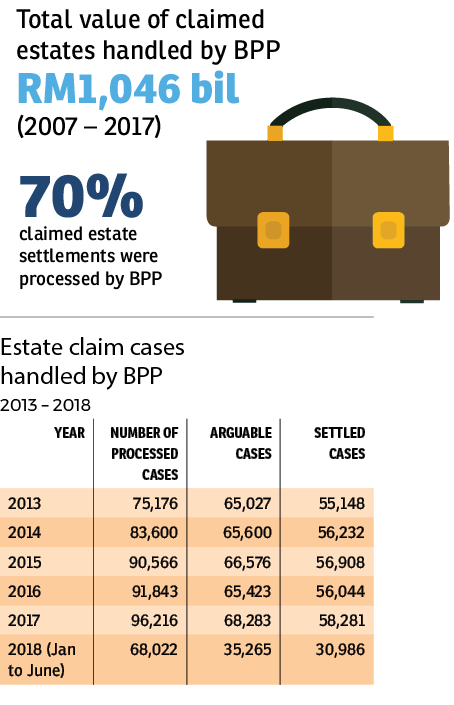

Unclaimed money act malaysia. Provision for payment into consolidated revenue account in certain cases of unclaimed money in court 6. The public sector agencies holding on to these monies would very much like to return the monies to the rightful owners but have not always been able to do so because they could not contact the owners despite repeated attempts to do so. If you re a 1st time user click on registration. These companies can face a fine of up to rm20 000 if they fail to comply while for a repeated offence a subsequent fine not exceeding rm1 000 for each day the offence continues.

An entity that fails to comply with the unclaimed moneys act 1965 shall be guilty of an offence and the entity and every officer of the entity who is in default shall be liable on conviction to a fine not exceeding rm20 000 and shall in the case of a continuing offence be liable to a further fine not exceeding rm1 000 for each day during which the offence continues. According to the unclaimed moneys act of 1965 every business corporation board and trade union in malaysia is legally obligated to report unclaimed money to the government so claimants can go to a central authority to track down this cash. Electronic government unclaimed money information system. Online checking unclaimed monies.

Unclaimed moneys 3 laws of malaysia act 370 unclaimed money act 1965 arrangement of sections section 1. The registrar of unclaimed moneys act the act has in recent times conducted random inspections on companies and businesses to review their compliance with the act. Under the unclaimed moneys act 1965 malay. Short title and application 2.

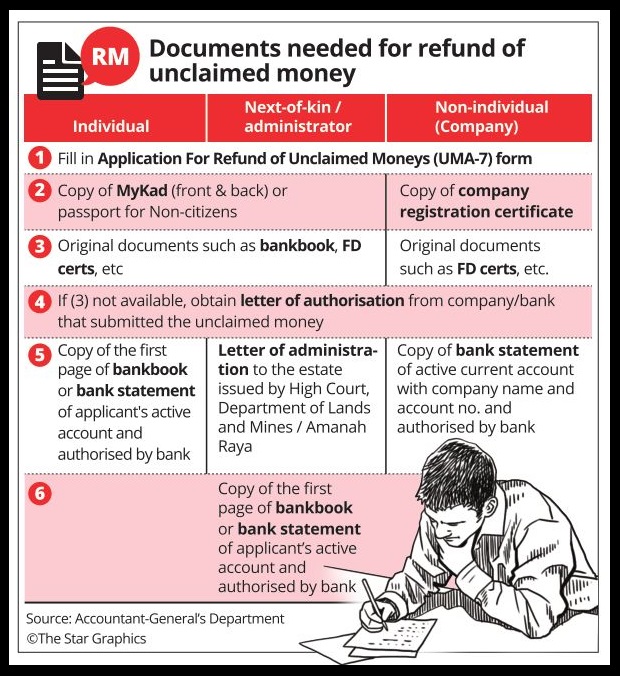

Once you ve created your account login and you must fill your address and contact number. The owner of the unclaimed moneys may recover the moneys from the registrar either in person or in writing. Saving part i moneys in court 5. According to section 10 unclaimed moneys act 1965 company firm is responsible for the following actions.

Basically unclaimed monies are made up of inactive bank accounts. Maintain a record of all unclaimed moneys in a register to be kept at its principal office or place of business in malaysia in the form to be determined by the registrar. Akta wang tak dituntut 1965 such sums of money will be transferred to the registrar of unclaimed moneys. Companies that are bound by the act must maintain records of unclaimed money and the funds if any have to be submitted to the registrar by march 31 each year.

This register publishes unclaimed amounts with singapore public sector agencies including ministries organs of state and statutory boards.